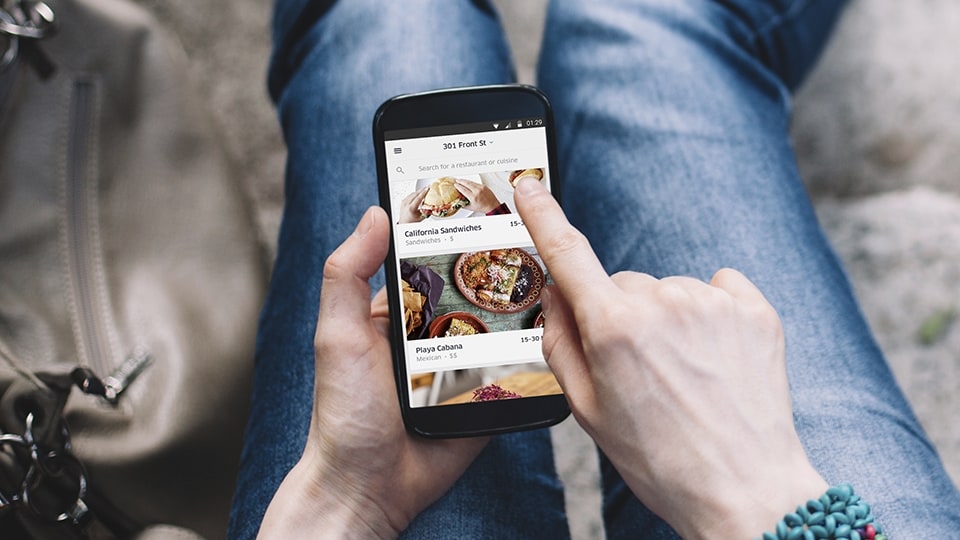

UberEATS is the on-demand food delivery service being rolled out by San Francisco-based Uber Technologies, best known for its taxi-hailing app. In January, India was announced as the latest frontier in its Asian development, following Bangkok, Singapore, Tokyo, Hong Kong and Taipei.

The potential of Asian markets has also attracted European food delivery brands. Deliveroo’s restaurant delivery model has made significant advancements in Singapore and Hong Kong, while Just Eat is a more firmly established vendor operating in the fast food sector (both based in the UK).

East versus west?

Although the expansion of Western food delivery companies in Asia has enhanced the region’s foodservice sector, the level of competition raises questions for aspirational companies.

UberEATS, for example, faces the daunting task of launching a successful delivery service in India where past domestic startups have failed. Ola Café was strongly reminiscent of UberEATS – it too was the brainchild of a cab-hailing app, Bangalore based Ola. It delivered food in Bangalore, Hyderabad, Delhi and Mumbai until March last year, when it was unceremoniously shut down. Its failure suggests that Western upstarts like UberEATS and Deliveroo may have trouble replicating the success they are witnessing in their American and European homelands.

Elsewhere, however, the outlook is bright. In Singapore, a launch pad for Asia’s high-end food delivery sector, UberEATS and Deliveroo have managed to establish a niche for themselves. This has been possible despite the steady expansion of FoodPanda, a homegrown startup (since acquired by German firm Delivery Hero), since its founding in 2012.

The evolution of food delivery services in Singapore is a good sign for the region. There is little reason to doubt the appetite for a similarly vibrant food delivery market in India, as the local know-how of startups like Swiggy is pitted against the ambition of new Western competitors like UberEATS and Deliveroo.

In Europe, the takeaway and delivery market is growing while the value of food bought in restaurants continues to decline. As Western delivery companies bring the competition to their Asian equivalents, foodservice professionals in the region should be poised to take advantage of a trend which shows no signs of slowing.

Thomas Lawrence