Hosted by Joanna Smart of Business Review, GlobalData’s webinar focused on the latest movements and newest predictions of the speciality and gourmet foodservice sector. Presenting was Tom Vierhile, the innovation insights director for GlobalData PLC. A veteran of the foodservice industry, Vierhile has over 20 years experience in packaged goods reporting and analysis.

Amalgamating the results of several GlobalData surveys and reports over recent years, the presentation honed in on eight key trends that are set to emerge in a big way over the course of 2018. A theme that prevailed throughout each trend was the drive for new flavours from under-explored geographic locations.

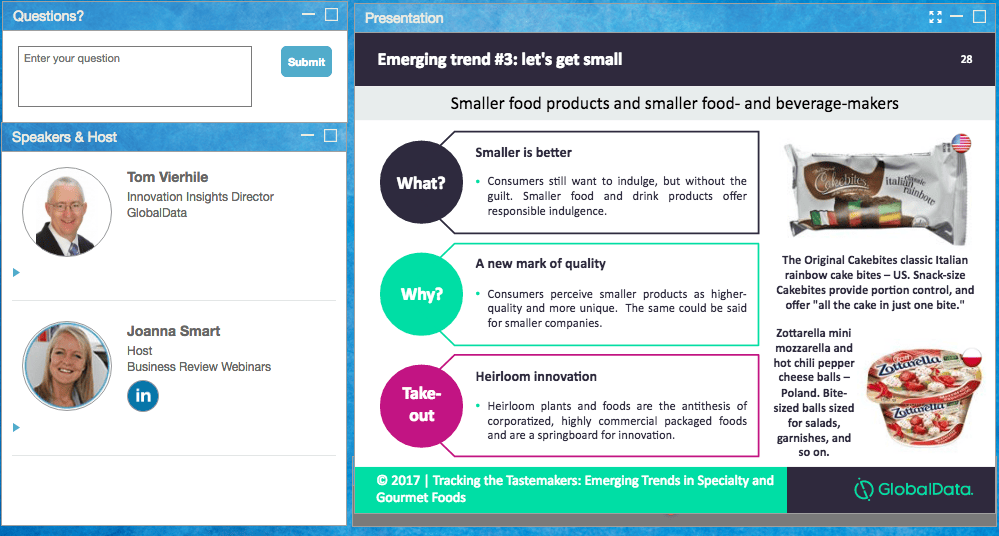

Less is more

Vierhile started off the webinar by tackling just what consumers believe to be speciality or gourmet products. Authenticity and unique flavour combinations were two key features, alongside size.

Consumers’ association of gourmet with speciality ingredients has subsequently led to the association of gourmet food with smaller batches, due to the perceived lack of availability and exclusivity of these ingredients.

The rise of smaller portions has also coincided with the health push that has been an overriding theme of recent years. As the percentage of consumers choosing to have a post-dinner dessert has declined by half since the 1980s, cake and pastry products have been met with hard times.

However, increasing healthy lifestyle choices has also led to a surge in consumers seeking a chance to gorge on a tasty treat, and small, sweet products allow the best of both – portion control and indulgence.

Smaller size is increasingly seen as a mark of quality, with independent companies paired with higher quality and unique products. Heirloom innovation was another key idea covered by Vierhile, as he explained these old-style fruits and vegetables as the antithesis of commercial corporations.

This trend towards smaller sizes and independent companies may seem negative for larger corporations. However, Vierhile cites companies such as Casamigos tequila distillery, co-founded by George Clooney and acquisitioned this year by UK drinks firm Diageo for $1bn, to highlight that bigger companies can take advantage of the success of smaller businesses.

Power of the past

Findings over the past several years have also shown that the younger generations have a propensity for the products of yore – perhaps surprisingly, even more so than older generations.

GlobalData asked consumers to state their stance on the statement: “products from the past are better than the ones available today”. Overall, 52% of those asked stated that they would “completely or somewhat agree” with the statement, and 57% of 25 to 34 year olds agree that products from the past trump those from more recent years.

With Vierhile stating that the “affinity for nostalgia is strong and rising among all age groups”, the obvious issue that arises is how foodservice companies can innovate, while embracing tastes from the past.

But Vierhile has emphasised the positivity of this trend, stating that consumers have a fondness for things they have grown up with. Inviting the foodservice industry to modernise flavours to make them relevant again, Vierhile’s webinar has made it evident that there is a goldmine of tried and tested flavours at the industry’s disposal.

Food without borders

However, the permeating theme throughout each emerging trend is taste. Each of the eight trends covered in the GlobalData webinar, including alcoholic flavourings and floral accents, are manifestations of a larger consumer focus on new taste and flavour experiences.

Flavour innovations often originate within the speciality and gourmet foods sector, says Vierhile, and this means that there is much experimentation with new or previously lesser-known ingredients, such as ethnic recipes.

Vierhile cross-referenced the findings of several surveys to conclude that African and South American flavours have the potential to provide new inspiration for innovation. When asked, American consumers revealed that Chinese, Italian and American were at the top of the list for ethnic cuisines consumed most regularly, at 37%, 34% and 19%, respectively.

Consumers were also asked which countries they associated with high quality food and drink. While Africa and South America received no votes, 60% of consumers chose Europe as a hub of luxury foodstuffs, and the US received an equally respectable 33%.

The lack of popularity of African and South American flavours looks promising, according to Vierhile, who sees the lack of consumer engagement with these countries’ cuisines as a chance to innovate with their unique flavours.

The take-home message

However, according to Vierhile, it is innovation itself that has been the largest influence on the foodservice industry. The rate of invention and change within the industry, combined with the low barrier entry for new companies, has led to a much quicker turnover of products and flavours than ever before.

The ability of social media to rapidly circulate information about new ingredients and commodities means that trends can now keep up with seasonal changes, such as Starbuck’s über-popular Pumpkin Spice Latte.

Overall, consumers have shown themselves as increasingly willing to pay higher prices for the sake of indulgence, and seeking out those brands that can provide the latest in flavour experimentation and innovation.

Emily Lewis